huntsville al sales tax rate 2019

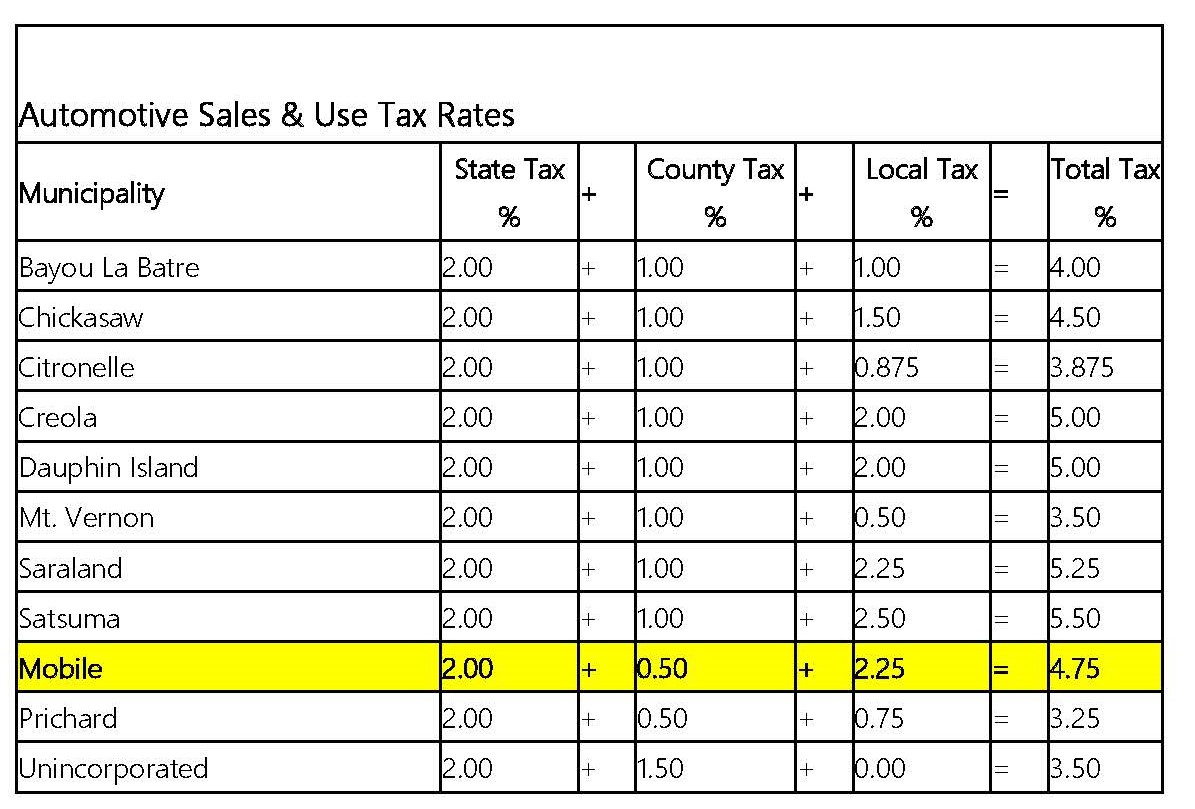

Automotive 40-23-24 40-23-61c. The sales tax jurisdiction.

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

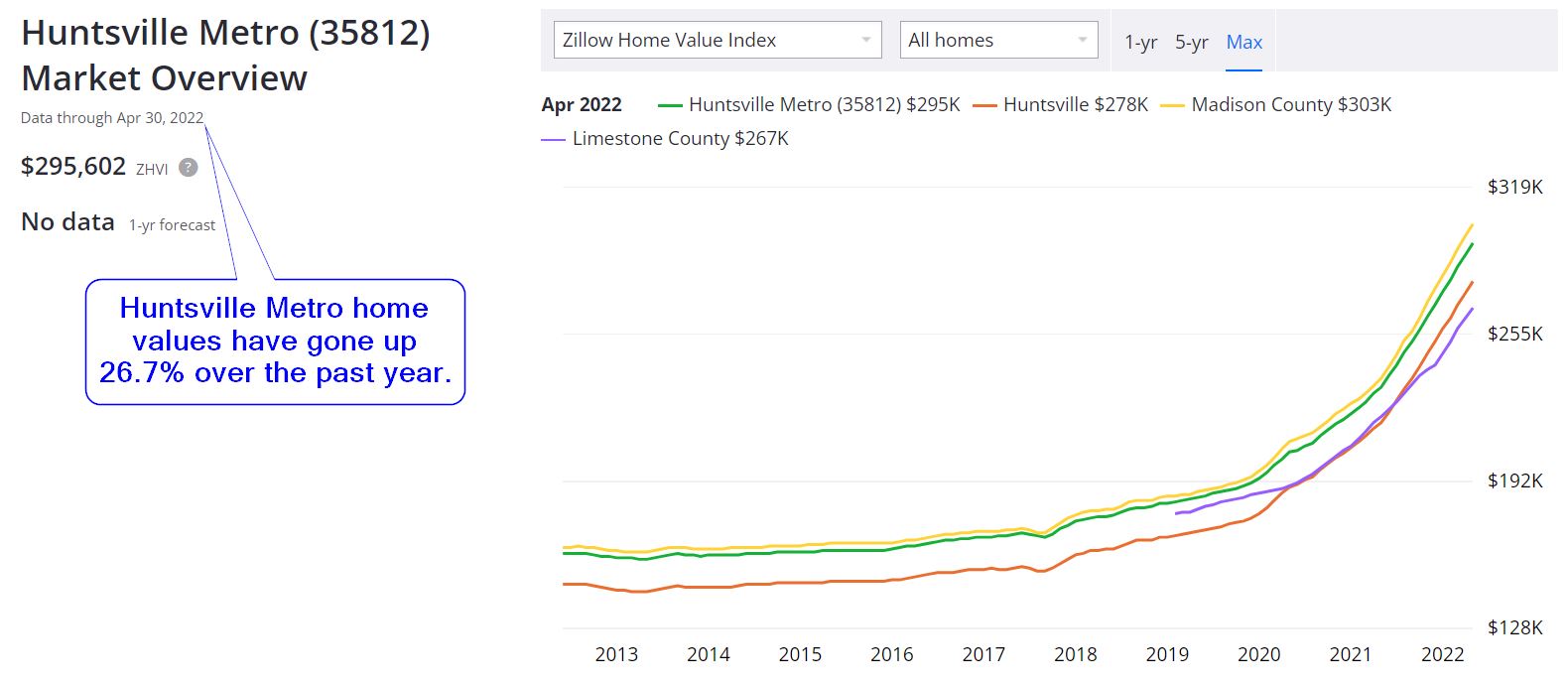

An alternative sales tax rate of 105 applies in the tax region Huntsville which appertains to zip code 35749.

. The minimum combined 2022 sales tax rate for Huntsville Alabama is. Sales Use Rental and Lodgings Tax Rates Sales and Use Tax Rates. This is the total of state county and city sales tax rates.

Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7There are a total of 372 local tax jurisdictions across the state collecting an. The December 2020 total local sales tax rate was also 9000. Lee County tax rates for sales made within the county.

1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760. The current total local sales tax rate in Huntsville AL is 9000. Rental Tax prior to 912019 Automotive.

City Hall 3rd Floor. An alternative sales tax rate of 105 applies in the tax region Huntsville which appertains to zip code. The Huntsville Alabama sales tax is 400 the same as the Alabama state sales.

400 Is this data incorrect Download all Alabama sales tax rates by zip code. The 9 sales tax rate in Huntsville consists of 4 Alabama state sales tax 05 Madison County sales tax and 45 Huntsville tax. Monday - Friday 800 AM - 430 PM.

There is no applicable special tax. Rental Tax prior to 912019. What is the sales tax rate in Huntsville Alabama.

Due to the impact of COVID-19 the City of Huntsville COH has authorized a tax payment extension for March 2020 and April 2020 Sales and Lodgings tax until June 1 2020 for. Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may. You can find more tax rates and.

State of Alabamas e-filing One Spot System To e-file your Huntsville return you must. The City of Huntsville requires electronic filing for all Sales Use RentalLease and Lodging tax returns. 308 Fountain Circle Huntsville AL 35801.

The Huntsville Arkansas sales tax rate of 85 applies in the zip code 72740. The Huntsville Alabama sales tax is 900 consisting of 400 Alabama state sales tax and 500 Huntsville local sales taxesThe local sales tax consists of a 050 county sales tax and. The City follows the same rules regulations definitions and procedures as are adopted by the Alabama Department of Revenue for the purposes of collection and administration of sales.

General 40-23-21 40-23-61a. The Harvest Alabama sales tax rate of 55 applies in the zip code 35749. Huntsville in Alabama has a tax rate of 9 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Huntsville totaling 5.

Alabama Counties With The Largest Property Tax Payments In 2018 Acre

Alabama Sales Tax Rate Changes May 2019

Sales Taxes In The United States Wikipedia

Taxes Mobile Area Chamber Of Commerce

Huntsville Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1004 Minor St Ne Huntsville Al 35801 Realtor Com

Used Cadillac Escalade For Sale In Huntsville Al Cargurus

Used Bmw For Sale In Huntsville Al Kia Huntsville

New Hyundai Kona For Sale In Huntsville Al

Used 2021 Hyundai Accent Sel In Huntsville Al Eagle Automotive Huntsville

Ohio Sales Tax Rates By City County 2022

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

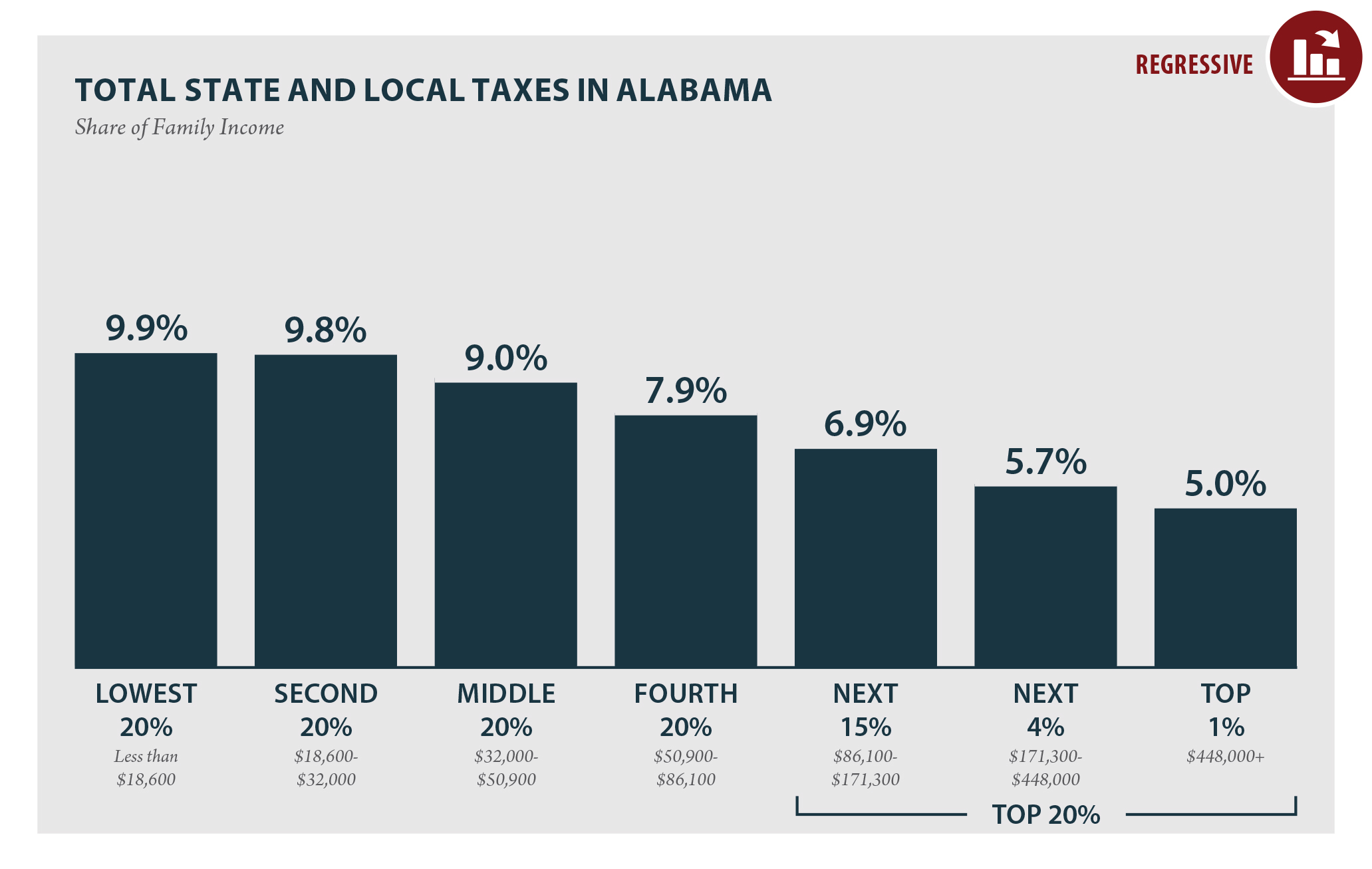

The Less You Make The More You Pay Alabama S Taxes Remain Upside Down Alabama Arise

Sales Tax Rates In Major Cities Tax Data Tax Foundation

2019 Banner Year For Huntsville Madison County Tourism Huntsville Business Journal

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

Huntsville Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders